The Post-College Portfolio

/PHOTO VIA

We are in an interesting position coming out of college. After living off of Christmas card money and meal points for four years, we now earn an adult-sized paycheck, and it’s probably more than we’ve ever earned in our lives. We now have all this money, and we don’t know how to manage it. While it may seem like a lot, after all the bills that you didn’t know you parents were paying, you find out it really isn’t. But you don’t need to be the next Wolf of Wall Street (in the financial literacy sense, not the raging drug addict sense) in order to construct a solid financial plan. In fact, by being young, you already possess the single most valuable asset when it comes to investing, one that even some of the best investors do not have - time. For you finance majors, this article may be a bit elementary, but that shouldn’t undermine its importance. No, we are not certified financial planners, but at this stage of the game you honestly don’t need one. You just need to focus on these two simple steps: setting up an emergency fund and saving for retirement.

Setting Up an Emergency Fund

The importance of this point cannot be stressed enough. What if the transmission blows on the 2002 Nissan Sentra you have been driving since high school? Sure, it’s a temporary set of wheels until you save enough to buy a new car, but now its gone and you still need to get to work in the morning. What if your employer has a rough quarter and is forced to lay off the new guy (you) in order to improve its bottom line? What happens when you find yourself in a flag football league matchup with your buddies when the opposing team’s linebacker has a flashback to his days in the Penal Football League and lays you out, breaking your arm in the process? While it may be difficult to think about, life can, and does happen.

And when it does, you want to be prepared by setting up an emergency fund as soon as possible. An emergency fund isn’t an investment; it’s a safety net to keep you from having to take money out of your investments to pay for unforeseen expenses, which can have huge consequences. Since you’ll need these funds unexpectedly, they need to be easily accessible. Something as simple as a savings account or money market account will do the trick. Try to sock away a little money each paycheck until you accumulate enough to cover about 6 months of expenses. The best way to accomplish this is to save the money before you even see it by setting up an automatic withdrawal from your paycheck into your emergency fund account. If your employer does not offer this feature, check with your bank to see if it offers automatic transfers from the account in which you deposit your paycheck to your emergency fund account. And remember, this is an emergency fund so don’t use it for discretionary spending. A fire sale at J. Crew does not count as an emergency.

Saving for Retirement

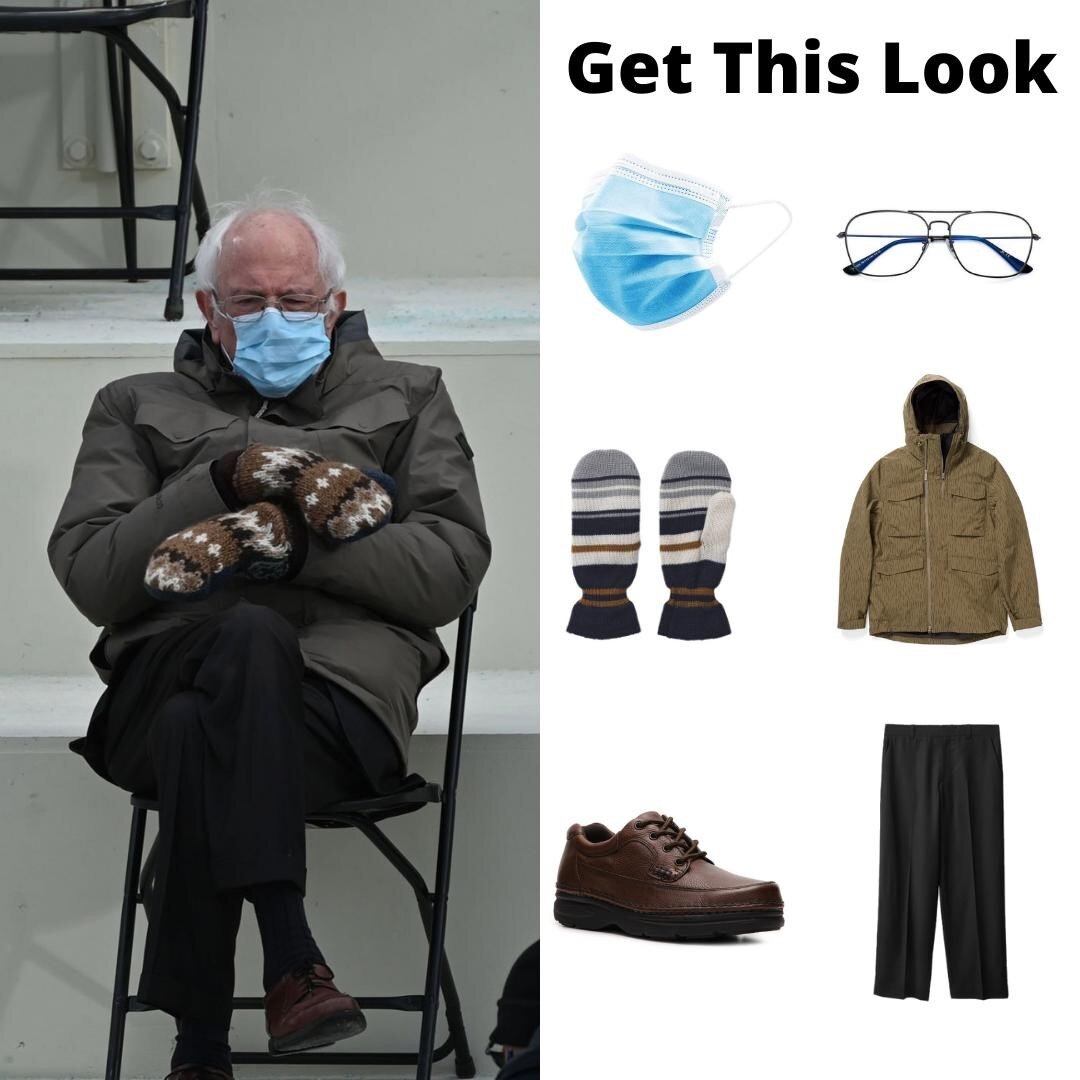

“Retirement? Me? But I’m only 23 years old. That’s over 40 years away! I don’t need to worry about that yet.” If this thought just crossed your mind, you couldn’t be more wrong. Remember when we said that the most valuable asset when it comes to investing is time? The reason for this is that time allows us to take full advantage of the phenomenon known as compounding. According to Investopedia, compounding refers to “the ability of an asset to generate earnings, which are then reinvested in order to generate their own earnings.” In other words, compounding is the process of earning a return on your accumulated returns, so its impact becomes greater and greater over time. Instead of putting you at risk of heart palpitations by describing the math behind this process, I’ll illustrate it using a simple graph.

PHOTO VIA

The blue line shows that if you save $300 per month beginning at age 25 (assuming an 8% return), you will have over $1,000,000 at age 65. The red line still shows you saving $300 per month but assumes you begin at age 35, which amounts to a total of less than $500,000 at age 65. Math aside, that’s a huge difference! In fact, you would have to save over $700 per month beginning at age 35 in order to match the age 65 savings of someone who began saving $300 per month at age 25.

So, now that I’ve convinced you to start saving as soon as you can, you may be wondering how to do it. The best place to start is with the 401(k) plan options offered by your employer. If your employer does not offer a 401(k), don’t worry, we’ll discuss alternatives later. Under a 401(k) plan, you make periodic contributions to an account based on percentage deductions from your paycheck, which are used to purchase investments of your choosing. Most employers offer to match your contribution up to a certain percentage as well, meaning that it will make additional contributions on your behalf based on the amount that you contribute. For example, if your employer matches 100% of the first 3% that you contribute and 50% of the next 2% that you contribute, it will contribute 4% of your pay as long as you contribute 5%. Your employer is paying you more if you save. It’s free money, so take advantage of it. And with that, I promise there will be no more math.

PHOTO VIA

Let’s look at 401(k) plans more closely. Assuming your company offers a 401(k) plan, you may have the option to make either traditional or Roth contributions. It’s important to understand the difference between the two because of their respective tax implications (financial advisors will probably try to lose you here so they can justify what they charge - I’ll do my best to not confuse you). As with traditional 401(k) accounts, Roth 401(k) accounts allow for your assets to grow tax-free. The difference lies in the taxation of contributions and withdrawals. With traditional 401(k) accounts, you contribute pre-tax dollars and are required to pay taxes at ordinary income rates when you make withdrawals. With Roth accounts, you contribute post-tax dollars in exchange for the ability to make tax-free withdrawals. The rule of thumb is if you expect your income in retirement to be higher than your current income, you should forgo the current tax break in favor of the future tax break and choose a Roth account. And unless you plan on becoming the resident surf instructor at a Hawaiian beach resort for the rest of your career, you will be making more.

Now, what do you do if you are self-employed or if your employer does not offer a 401(k) plan? Aside from finding a new employer that gives a damn about you, the answer is to open an individual retirement account (IRA). IRAs have both traditional and Roth options and work similarly to 401(k) plans from a tax perspective, but they pertain only to individuals rather than a group of employees working for the same company. An IRA can be painlessly opened with a number of different well-known providers, including Vanguard, T. Rowe Price, and Fidelity.

This is a lot of information to digest, so let me provide you with a road map for your decision making. Let’s assume Roth contributions, for the reasons discussed above, are best for you. Therefore, if your employer offers a Roth 401(k), you'll want to focus on maxing out your annual contribution ($18,000 in 2015). If you can’t max out your contribution yet, be sure to contribute at least enough to earn the full company match. If your employer only offers a traditional 401(k) plan, contribute just enough to get the full company match (free money!) and direct any further savings into a Roth IRA account for the tax advantages discussed above. Lastly, if your company does not offer any sort of 401(k) plan, direct all of your savings into a Roth IRA account. For 2015, IRAs have a $5,500 annual contribution limit.

By now you’re probably drooling on your keyboard, but remember, this is important. I know first hand how difficult it can be to save money early in your career, especially in light of major financial obligations like rent and student loan debt as well as trying to scrape up enough cash to travel, go out with friends, and look damn good doing it. But the future will undoubtedly bring its fair share of challenges. Whether it’s paying for an unforeseen car repair or building an adequate retirement savings, with a little financial planning, you can overcome these challenges with ease. So, when you’re 70 years old, gazing out at the ocean from the porch of your house in the Caymen Islands, sipping a cold one (or many), still blasting Watch the Throne by Jay-Z and Kanye West, hopefully you’ll be able to look back and realize that setting up an emergency fund and beginning to save for retirement in your 20s were some of the most rewarding financial decisions of your life.

Feel free to post any questions or share your financial experiences in the comments section below.